Impact of GST Rate Changes on Sports Jersey Industry: Analysis and Future Trends with IT Integration

With the lively development of the worldwide sports activities industry, jerseys, as an vital service of sports activities subculture, have seen a continuous boom in market demand. this text will discover the effect of modifications in the GST (goods and offerings Tax) charge on the jersey enterprise, examine the coping strategies of jersey manufacturers, and sit up for the future development developments of the enterprise and their correlation with GST policies.

Overview of the Jersey Industry and Impact of GST Tax Rate

The review of the Jersey industry

Jerseys, as the iconic equipment of sports activities occasions, are not simplest the degree for athletes to showcase their however also the service of emblem photo and culture. With the full of life development of the sports activities enterprise, the jersey enterprise has additionally grown an increasing number of sturdy, protecting everything from reliable jerseys of pinnacle leagues to custom gadget for beginner groups, as well as the retail marketplace of numerous sports brands.

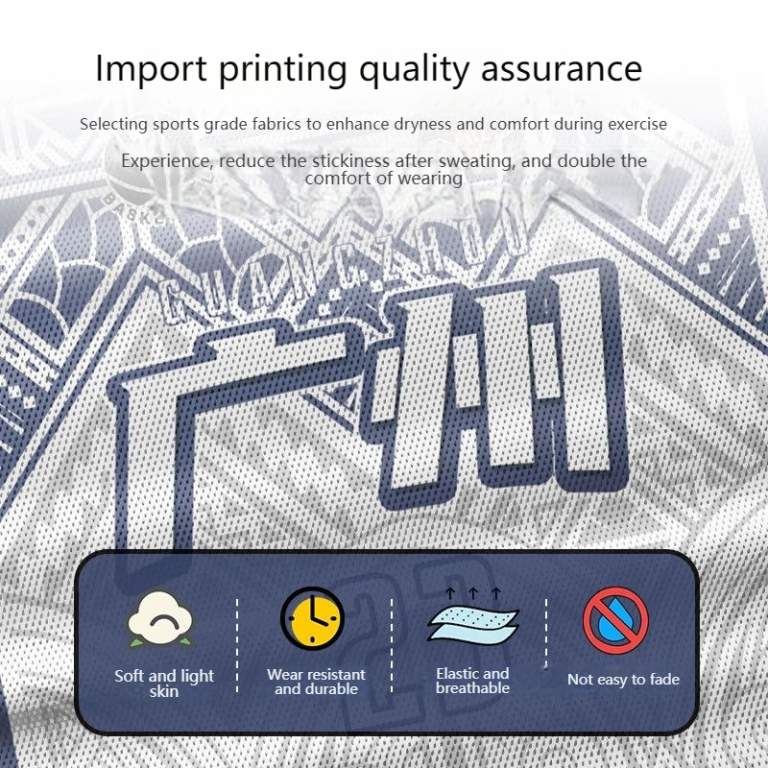

The jersey industry has an extended,concerning more than one tiers from design, production, to income. Designers are liable for integrating emblem ideas and athletic aesthetics into jersey design, whilst the production phase consists of procedures which includes cloth choice, cutting, and sewing. With the improvement of technology, jersey fabrics are trending towards being lighter, breathable, and more functional to satisfy the needs of athletes beneath diverse climatic and competitive situations.

Tax policies have a tremendous impact on costs inside the improvement of the jersey enterprise. as an instance, in India, the advent of GST (items and services Tax, goods and offerings Tax) has had a tremendous effect on the jersey industry.

impact of GST Tax costs

for the reason that implementation of GST in India in 2017, the tax quotes for the jersey enterprise have undergone numerous modifications. initially, jerseys were categorised as clothing and challenge to a 17% tax charge. This charge supposed extended costs for jersey manufacturers and retailers, mainly in the context of growing raw fabric and exertions fees.

as the GST tax quotes were adjusted, the fee shape of the jersey industry has changed. On one hand, changes in tax fees immediately affected the very last promoting price of jerseys, thereby influencing customer buying intentions. alternatively, charge modifications additionally forced producers to are seeking for price optimization strategies to mitigate the impact of tax on profitability.

To address the challenges delivered by GST tax rates, jersey producers have taken diverse measures. for instance, they have installed lengthy-term partnerships with providers to lessen uncooked cloth costs; optimized production techniques to growth efficiency; and altered product structures to develop extra value-effective product lines.

The implementation of GST has additionally promoted the standardization of the jersey industry. because of the unified tax fees, transactions among jersey producers and retailers have become greater transparent, supporting to fight unlawful markets and guard consumer rights.

underneath the have an impact on of GST tax quotes, the jersey enterprise has experienced modifications to its fee structure and intensified market competition. manufacturers and shops should constantly adapt to changes in tax regulations, retaining competitiveness via innovation and optimization. at the identical time, the implementation of GST has contributed to the enterprise’s development closer to a greater standardized and green route.

Analysis of the Impact of GST Rate Adjustments on the Cost of Soccer Shirts

The adjustment of GST (items and services Tax, i.e., fee delivered Tax) in the production technique of football jerseys has a multifaceted impact on expenses. the following is an in depth evaluation of this impact:

-

accelerated raw cloth charges: An growth in the GST charge directly results in a heavier tax burden on raw fabric providers, which in flip affects the manufacturing fees of soccer jerseys. for instance, the procurement expenses of simple substances including fabric, sewing threads, buttons, and so forth., rise notably, main to a vast boom within the uncooked material charges of soccer jerseys.

-

rising production prices: the manufacturing procedure of football jerseys is likewise stricken by adjustments in GST quotes. for instance, the charges of gadget and substances required for techniques together with sewing, printing, and warm stamping growth due to the rise in GST, not directly boosting the manufacturing expenses of soccer jerseys.

-

increased indirect charges: The upward push in GST quotes also ends in an increase in a sequence of indirect expenses, together with transportation, warehousing, and exertions expenses. Logistics companies that delivery the raw substances and completed soccer jerseys are required to pay more GST, which absolutely will increase the running costs for jersey manufacturers.

four. sales charge modifications: confronted with the pressure of growing costs, jersey producers may additionally choose to alter their income expenses to preserve a positive earnings margin. however, customers are tremendously sensitive to fees, and a rate boom may additionally lead to a decline in income quantity, thereby affecting the overall sales of producers.

five. aggressive pressure: The adjustment of GST quotes influences football jersey producers of various scales differently. massive manufacturers may be capable of take in part of the expenses thru optimized deliver chain and internal control, even as small and medium-sized establishments may also face more commercial enterprise stress. this can lead to a exchange in market shape and similarly intensify the competitive panorama.

-

deliver chain adjustments: The adjustment of GST charges prompts jersey manufacturers to reconsider and adjust their deliver chains. some producers may additionally are searching for decrease-value raw materials and manufacturing offerings to alleviate the burden of GST. this may cause a reconfiguration of the supply chain, impacting the long-term improvement of the entire enterprise.

-

effect on lengthy-time period investments: changes in GST costs may additionally affect the producers’ long-time period funding selections. as an instance, producers can also postpone plans to invest in new system and technology to lessen the pressure resulting from the growth in GST inside the short time period.

-

impact on monetary reporting: The adjustment of GST quotes also impacts the manufacturers’ monetary reporting. for instance, adjustments in tax charges can also trigger changes in stock valuation strategies, thereby impacting the net income in the monetary statements.

The impact of GST price modifications on the value of the football jersey enterprise is complete and profound, affecting no longer simplest raw materials and manufacturing strategies but also deliver chain control, marketplace opposition, long-term investments, and monetary reporting at multiple ranges. manufacturers need to actively respond by way of optimizing management and adjusting strategies to relieve cost pressures, ensuring competitiveness in the acute marketplace opposition.

Apparel Manufacturer’s Response Strategy and Cost Control

within the context of GST tax changes, clothing producers face the stress of growing expenses. here are some not unusual techniques and value manipulate measures to deal with this case:

-

Optimizing supply Chain controlmanufacturers can lessen procurement expenses by means of optimizing the supply chain shape, putting off middlemen, and immediately taking part with raw fabric suppliers. additionally, through centralized procurement and bulk ordering, they can negotiate more favorable reductions and expenses.

-

Passing fees to Downstreamfaced with growing raw fabric prices, some manufacturers pick to shift the price burden to downstream customers by means of growing the retail charges of jerseys. This strategy can assist alleviate brief-term price pressures, but it could have an effect on customer shopping intent.

three. modern production technologyby way of introducing advanced fabric and printing technology, manufacturers can enhance production efficiency and reduce exertions and electricity prices according to unit product. moreover, via studying and developing fabrics and processes, they are able to decrease pollution and aid intake at some stage in manufacturing.

- Strengthening inner managementproducers can reduce non-production charges thru inner management optimization. for instance, improving worker schooling to improve manufacturing performance; strictly controlling material utilization to minimize waste; and optimizing warehousing and logistics to lower inventory charges.

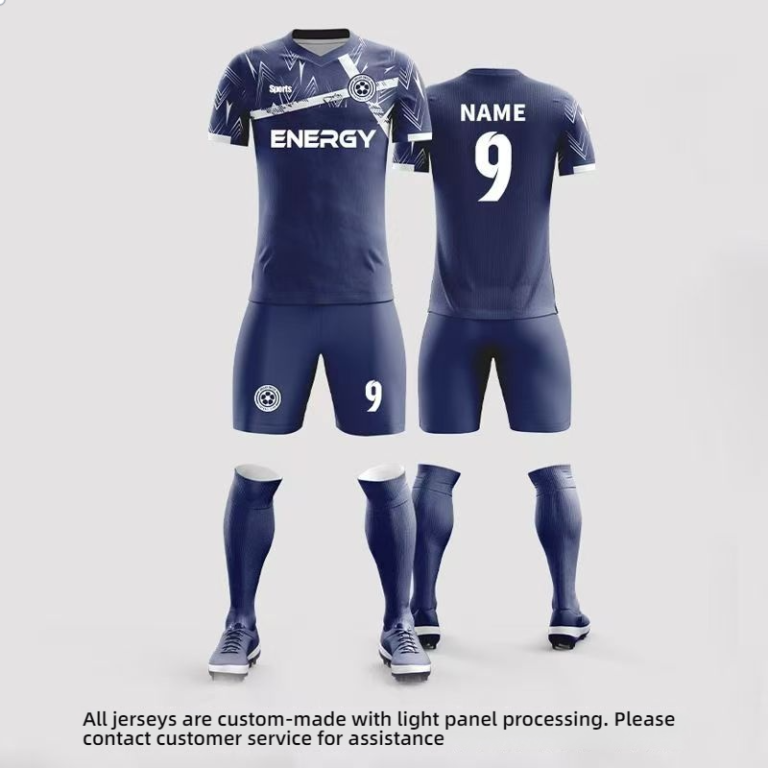

five. expanding diverse Marketsdevelop different priced jersey merchandise for various marketplace segments. For the high-end market, offer , excessive-cost-added products; for the mid-to-low-give up market, launch products with better value-performance to attract greater purchasers.

-

setting up logo CollaborationsCollaborate with sports activities manufacturers or soccer clubs to co-broaden jersey merchandise. via logo synergy, enhance product cost and increase sales charges, thereby alleviating price pressures.

-

Adjusting production PlansFlexibly adjust manufacturing plans based on market demand adjustments. as an example, lessen manufacturing of excessive-price, low-earnings products and boom output of high-income, in-demand merchandise.

-

Optimizing advertising and marketing techniquesgrowth brand awareness and product income thru multi-channel advertising online and offline. at the identical time, make use of emerging advertising and marketing strategies consisting of social media and live streaming to lessen traditional advertising costs.

nine. promoting standardscombine concepts into product layout, together with the use of biodegradable materials and printing strategies. This not only allows lessen production expenses but additionally enhances emblem photograph, attracting customers with a robust environmental consciousness.

- Valuing talent improvementdomesticate a group with progressive attention and professional skills, laying a basis for the employer’s lengthy-term development. Optimize the expertise structure thru internal promotions and outside recruitment, improving the overall competitiveness of the corporation.

through imposing these techniques and measures, apparel producers can alleviate the value stress delivered approximately by using GST tax changes to a degree and keep strong commercial enterprise development. but, within the lengthy-time period improvement, manufacturers still need to carefully monitor coverage adjustments and constantly regulate enterprise strategies to adapt to changes in the marketplace environment.

Impact of GST rate changes on consumer purchasing power

The upward push in jersey costs directly influences clients’ budgets. With the change in GST (goods and offerings Tax) prices, the fee of producing jerseys has expanded, forcing manufacturers to elevate costs to maintain income. for many customers, this means that the previously cheap rate of jerseys turns into not possible, especially for those with restricted budgets.

-

price increases without delay effect consumers’ budgets. The increase in GST costs leads to higher manufacturing charges for jerseys, compelling producers to elevate fees to keep profits. for lots purchasers, because of this the previously affordable price of jerseys turns into unaffordable, mainly for those with confined budgets.

-

reduced client willingness to purchase can also cause a decline in market call for. within the face of growing expenses, clients may also lessen their frequency of purchase or even pick out to forego shopping for. For brands and retailers, this lower in patron willingness to buy should result in a decline in sales volume, impacting the overall market performance.

three. consumers might also flip to replacement products or more cost-powerful alternatives. beneath price stress, purchasers might also are looking for out cheaper, extra price-effective alternatives, inclusive of unauthorized jerseys, 2d-hand markets, or different sports system. This shift may pose a venture to formally legal jersey brands.

-

long-term effects may additionally lead to a decrease in client loyalty. If GST rates retain to upward push, purchasers may also increase dissatisfaction with brands, especially for the ones who have been lengthy-time period supporters. This dissatisfaction should step by step lead to a decline in emblem loyalty.

-

consumers may additionally are trying to find promotional reductions. After the adjustment of GST prices, customers may additionally pay greater attention to promotional discounts to buy favored jerseys inside their constrained budgets. This calls for producers and stores to be extra bendy in their pricing techniques to attract purchasers.

-

clients’ price sensitivity will increase. After the tax price exchange, purchasers’ price sensitivity will appreciably growth, and they are more willing to make purchases while fees are solid or falling. which means manufacturers need to pay extra interest to cost manage and pricing strategies.

-

clients can also flip to domestic brands. For some purchasers, home brands can be extra competitive in terms of pricing. With the alternate in GST charges, purchasers can be extra willing to assist domestic manufacturers to alleviate the burden of rising expenses.

eight. in the end, consumption behavior may additionally alternate. If GST costs stay excessive for a long term, clients can also regularly alter their consumption conduct, lowering purchases of non-crucial items, with the intention to have an extended-term impact at the entire sports clothing marketplace.

In precis, the effect of the GST price exchange on patron purchasing electricity is multifaceted, affecting not only price increases and a lower in purchase willingness but also probably triggering a series of market behaviors and changes in intake conduct. producers and outlets want to carefully reveal this trend and take appropriate measures to conform to marketplace modifications.

Industry Future Trends and Considerations for GST Policy

The garment enterprise is going through a series of demanding situations and opportunities in the wake of changes in the GST (items and services Tax, cost added Tax) charges. the following is a particular evaluation of the industry’s future developments and considerations when it comes to the GST policy:

-

Optimization of textile fabric deliver ChainWith the adjustment of GST costs, garment manufacturers need to re-examine and optimize their raw cloth supply chain. by way of introducing more efficient supply chain control structures, which includes organising long-time period partnerships with suppliers, they are able to reduce procurement prices whilst making sure the excellent and balance of uncooked fabric supply.

-

Innovation in production processesTo cope with the cost pressure from growing GST costs, garment producers pays extra interest to the innovation of production techniques. Adopting automatic and smart manufacturing device can enhance manufacturing performance, reduce hard work charges, and enhance product first-class and competitiveness.

three. market Segmentation and DifferentiationThe alternate in GST quotes might also result in a reduction in purchases through charge-sensitive customers, so garment producers need to further phase the market and launch differentiated product strains for one of a kind customer organizations. as an instance, introducing value-effective access-stage products and high-give up customized services to fulfill various client desires.

four. growth into cross-border E-commerceconfronted with domestic marketplace pressures, garment producers can make bigger into cross-border e-commerce to tap into global markets. move-border e-commerce can pass better GST rates within the home market, optimize logistics and tariff techniques, and reduce the very last promoting price of products, improving market competitiveness.

-

emblem building and advertising techniquesWith the adjustment of GST fees, brand constructing has become an important approach to lessen charges and decorate value-brought. Garment producers must increase their funding in emblem building, beautify emblem popularity and reputation, and entice dependable consumers, that may partially offset the negative effect of the charge boom.

-

policy usage and Compliance managementproducers want to intently monitor modifications inside the GST coverage, make reasonable use of tax incentives such as export tax refunds and research and improvement fee deductions, and reduce tax burdens. on the identical time, make stronger compliance management to ensure that the company’s operations follow tax legal guidelines, warding off extra prices because of non-compliance.

-

green Environmental safety and Sustainable improvementWith the global emphasis on environmental protection, garment manufacturers should consider integrating inexperienced environmental protection standards into product layout and production techniques. This no longer simplest facilitates decorate brand picture but can also win applicable environmental tax deductions inside the GST coverage concerns.

-

market Diversification and hazard DispersalTo lessen dependency on a single marketplace, garment producers have to explore varied markets which include sports system condominium markets and customized jersey markets, attaining hazard diversification. on the same time, thru assorted operations, enhance standard danger resistance capabilities.

nine. virtual Transformation and Technological Integrationdigital transformation is an critical strategy to address modifications in GST prices. via introducing technology inclusive of massive information and cloud computing, acquire clever production, sales, and offerings, improve performance, and decrease costs.

- expertise development and team constructingunderneath the impact of the GST policy, garment producers need to reinforce expertise development, beautify the professional abilties and innovative talents of employees. thru group building, enhance universal execution capability, and reply to marketplace modifications.